What was the distribution of wealth in Ireland c. 1300?

Published in Features, Issue 4 (July/August 2019), Volume 27Exploring medieval Ireland’s economy via papal taxation records.

By Chris Chevallier

There are multiple obstacles hindering the study of the Irish medieval economy. Regionalism and political divisions spatially limited the effective administrative reach of the colonial government. Shifting alliances, conflict and a frontier in constant flux exacerbated this issue. Concerning existing records, colonial financial documents often take the form of Inquisitions Post-Mortem and manorial extents. Although useful, these documents are localised and random in terms of chronology. Gaelic sources, on the other hand, tend to focus on familial deeds and genealogies rather than charters or material accounts.

There are multiple obstacles hindering the study of the Irish medieval economy. Regionalism and political divisions spatially limited the effective administrative reach of the colonial government. Shifting alliances, conflict and a frontier in constant flux exacerbated this issue. Concerning existing records, colonial financial documents often take the form of Inquisitions Post-Mortem and manorial extents. Although useful, these documents are localised and random in terms of chronology. Gaelic sources, on the other hand, tend to focus on familial deeds and genealogies rather than charters or material accounts.

Regionalism also contributed to diverse economic livelihoods. Economies existed on a spectrum between a Gaelic archetype (based more on pastoralism, direct consumption, bartering and billeting), well suited to surviving endemic warfare (i.e. cattle-raiding), and an English or Continental archetype (grounded in coin use, manorialism, commercialisation and intensive agriculture). This creates difficulties when trying to uniformly quantify and evaluate wealth, as regions—and even local manorial economies—could exhibit characteristics of both archetypes concurrently.

Because of this heterogeneity and dearth of sources, economic studies on medieval Ireland are generally regional or local, with very limited fine-grained information. There is a need for a nationwide source that can transcend political, economic and cultural boundaries. This comes in the form of papal taxation documents. Indeed, these sources offer the only means of uniformly analysing Ireland’s economy on a multilevel scale, as the papacy’s authority transcended secular divisions. Thus they allow us to address the question of the distribution of wealth in Ireland c. 1300.

Sources

The basis of the work is six rolls currently held in the British National Archives (Kew), as well as data contained within the Red Book of Ossory and the Christ Church Deeds. These documents contain valuations made between 1302 and 1320 for the purposes of the papal tenth (or decime). This was an irregular but not infrequent 10% tax on clergy for the purpose of supporting crusades or the amelioration of papal emergencies, such as conflicts with the Holy Roman Empire or other antagonists of the Papal States. Their utility for economic research is invaluable, as parish incomes (largely tithes) were based on the wealth of local economies. Parish valuations can therefore be used as relative economic proxies. Moreover, some dioceses that were valued between 1302 and 1307 (ante-bellum) were revalued in 1319–20 (post-bellum). This allows insight into the devastation caused by the Bruce Invasion and the Great European Famine.

The ante-bellum records provide information for nearly the entirety of Ireland. Some areas, however, are excluded. There is no information at all for Ferns (Wexford), and only limited information (e.g. bishops’ and officers’ incomes) for the predominantly Gaelic or frontier dioceses of Kilmore, Clonmacnoise and Ardagh. Much of Louth and part of Armagh are also missing. This is to be expected, as this region was fiercely independent during this time and embroiled in conflict. The works of Brendan Smith are particularly illuminating on this issue. Mapping the data has also revealed that some sub-regions, such as parts of western Connacht, appear to have escaped valuation.

Methods

The research was pursued in three stages: papal financial studies, place-name reconciliation and geographical analysis. The first stage involved analysing papal and English royal documents, as well as visits to the British National Archives, the Archives Nationales (Paris) and the Vatican Secret Archives. The purpose of this work was to understand the nuances of these taxations, as well as to ensure that the valuations were viable for economic analysis. Primary sources strongly indicate that by 1302 papal tenth procedures had become refined and uniform. In addition, valuation instructions show that a wide range of economic activity—including the sale of livestock and the produce of pastoral activities—was comprehensively included in these assessments.

The second stage entailed attaching the medieval parish valuations to the coordinates of their corresponding medieval church site. The place-names within the 1302–20 valuations can be difficult to decipher, as many Irish place-names were rendered phonetically by non-Irish-speakers. For example, one can see very different spellings of the same parish when comparing ante-bellum and post-bellum data. Gall stains, wear and tear and difficulties of palaeography add to the problem. And there are other values outside of parishes, such as religious houses. Nevertheless, parishes provide the best and most uniform proxies for local economies.

With the assistance of royal visitation records, the Logainm database, diocesan histories, county archaeological reports and atlases, the Historical Environment Viewer, the Irish Historic Towns Atlas Project, the Down Survey and the nineteenth-century Ordnance Survey maps, a majority of parishes (1,571 for the ante-bellum dioceses, to be precise) were concretely tied to a church site. Those that could not be tied to their church site (or to a townland in a few select circumstances) or were incompletely valued were not included. Regarding the latter, the Knights Templar and the Hospitallers held portions of ecclesiastical revenues that were exempt from taxation, rendering only part of the income valued.

The works of William Reeves (Ecclesiastical antiquities of Down, Connor, and Dromore and the Taxatio Ecclesiastica Hiberniae), as well as the fifth volume of the Calendar of documents relating to Ireland, also assisted with this process. It must be noted, however, that Reeves’s Taxatio Ecclesiastica Hiberniae remains unpublished (currently archived at the Robinson Library, Armagh), while the fifth volume of the Calendar was published in a somewhat incomplete and unsatisfactory state after the death of its editor.

Once the second stage was completed, a geodatabase was created that allowed the data to be inputed into ArcGIS (a geographic information system) and projected with precision. This brings us to the third and final stage: geographical and statistical analysis. The valuations can be projected onto different basemaps as points, and alongside a wide array of historical (e.g. towns, ports, castles and manors) and environmental data. Furthermore, the use of a geographical information system allows for quantitative analysis. This means that density, cluster, hotspot, distance and regression analyses, as well as different visualisations to abet qualitative analyses, can be carried out with the sources.

Results

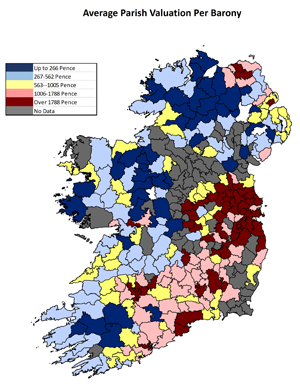

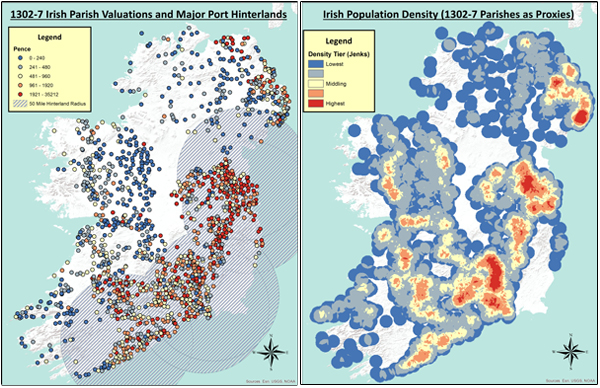

The mapping and analysis of the 1302–7 valuations illustrate a complex and nuanced economy in medieval Ireland. The first map (p. 18) reflects parish values aggregated into baronies to make the data more legible and to flesh out local trends. There is a clear and drastic dichotomy between independent Gaelic lordships and colonial territories, with few smooth gradients between them. This is perhaps best exemplified at the border of the earldom of Ulster. Exceptions to this can be found, though, at the southern coast of Cork and northern Tipperary. Both were border regions between marcher and Gaelic lordships. Wealth and parish density are disproportionately concentrated within colonial domains, deceptively reinforcing traditional dichotomies and understandings of medieval Ireland. Exploring factors such as urbanisation, environment, commerce and conflict, however, help us to move beyond simplistic portrayals of Ireland.

The colony can be described as a network of urban cores, each with a hinterland of varying geographical extent and economic impact. The main body of the colony primarily conforms to a contiguous expanse of fertile lowland stretching through much of Leinster and across northern Munster. This not only was a boon to manorial economies but also enabled more complex demographic patterns and settlement networks (i.e. high population density and urbanisation). Thus the preponderance of Ireland’s towns and cities are found within the area. Urbanisation was essential for turning agricultural surpluses into wealth, for economic specialisation and for connecting to intra-national and international commercial routes. As illustrated in the second map (p.19), wealth largely fell within 50 miles of the five top customs-paying ports (Drogheda, Dublin, New Ross, Waterford and Cork).

It is surprising that such high valuations penetrate westward from Dublin to Mullingar. Nevertheless, the areas where parish valuations were not carried out combine with historical records of conflict to indicate areas where colonial control was faltering. The Ó Conchubhair Failghe, for example, were a major force in the midlands that defeated multiple colonial armies. Fear or ongoing conflict probably deterred papal agents from travelling into their domains, as well as into other midland Gaelic lordships. Aside from this, the Wicklow Gaelic septs, irate at being forced into highland terrain, descended upon northern Wexford (i.e. Ferns diocese). This is a likely explanation for the absence of the area’s valuations, as well as some low-valued parishes in Carlow and valuation gaps along the Leinster coastline.

Geraldine Desmond, the earldom of Ulster and Butler territories also exhibit signs of strong economic performance despite limited military support from the colonial administration (which was often geographically confined to Leinster) and distance from Dublin’s economic hinterland. Hotspots of wealth can be found at Kilkenny, Lismore, the south-eastern hinterland of Limerick and Coleraine. This is a testimony to the resilience of Norman-Irish lordships. Richard Óg de Burgh, the Red Earl of Ulster, for example, was a noted political leader who was able to exact tribute from neighbouring Gaelic kingdoms while balancing their political intrigues in his favour. Even as the colony was facing difficulties, he expanded his influence into Derry. The Desmond Geraldines became immersed within Gaelic culture, while the works of C.A. Empey have shown that the Ormond Butlers and their associated lords also acclimatised to Gaelic culture and politics. This assimilation undoubtedly contributed to the longevity of their influence in Munster.

The colony largely failed to make a widespread economic impact in Connacht. The province’s wealth is largely concentrated in south County Galway, where de Burgh authority was the strongest (e.g. Galway, Athenry and Loughrea). Conversely, the diocese of Elphin was especially impoverished and the valuations cite several parishes being wasted by war. This meshes with annalistic accounts of endemic raiding and internal conflict within the Ó Conchubhair dynasty. The colonial presence in the diocese was largely confined to castles and outposts, situated as a check against the Ó Conchubhair. Constant conflict likely suppressed the economy in the province for all factions involved, despite the presence of some ideal environmental factors. What Connacht represents is a frontier where lords competed and cooperated for their political goals, but one that was not subject to heavy settlement or major influence from the colonial administration in Dublin. Keeping this in mind, it becomes imperative to move away from presenting the colony as a singular entity. Rather, the research reinforces Robin Frame’s characterisation of the colony as a patchwork of lordships.

The colony largely failed to make a widespread economic impact in Connacht. The province’s wealth is largely concentrated in south County Galway, where de Burgh authority was the strongest (e.g. Galway, Athenry and Loughrea). Conversely, the diocese of Elphin was especially impoverished and the valuations cite several parishes being wasted by war. This meshes with annalistic accounts of endemic raiding and internal conflict within the Ó Conchubhair dynasty. The colonial presence in the diocese was largely confined to castles and outposts, situated as a check against the Ó Conchubhair. Constant conflict likely suppressed the economy in the province for all factions involved, despite the presence of some ideal environmental factors. What Connacht represents is a frontier where lords competed and cooperated for their political goals, but one that was not subject to heavy settlement or major influence from the colonial administration in Dublin. Keeping this in mind, it becomes imperative to move away from presenting the colony as a singular entity. Rather, the research reinforces Robin Frame’s characterisation of the colony as a patchwork of lordships.

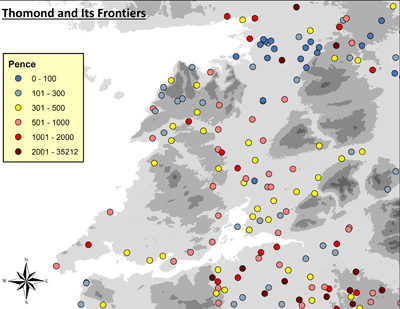

Gaelic Ireland, relative to colonial domains, is defined by low-tier valuations and low density. High-tier parishes exist but they are much less consistent. The relative disparity can be attributed, in part, to environmental factors. The ‘Great Irishry’ (western and central Ulster), Ó Briain Thomond and the kingdom of Desmond are largely defined by podzols, gleysols and leptosols, more suited to pastoralism than to intensive agriculture. Moreover, hilly and rocky terrain created potential barriers to higher population density, networks and political unification. Indeed, these areas largely consist of isolated parishes nestled within mountain chains. The third map (p. 20), which uses parish density as a proxy for population, highlights this interplay between the environment and demographics. What is also important to note is the relative isolation of these regions from major urban ports, or, as in the case of Desmond and Thomond, the physical barriers to accessing them.

Of all the mapped Gaelic territories, Thomond exhibits a more consistent degree of moderate density and wealth (see map, p. 21). This is likely due to the strength and influence of the Ó Briain dynasty. The Mac Cárthaigh of Muskerry and Mag Uidhir of Fermanagh also benefited from a higher degree of wealth, something which meshes with annalistic accounts of their power and prosperity. While the Ó Néill and Ó Conchubhair do not have consistent indications of wealth, they do appear to have ruled over some pockets of middling population density. This demographic edge likely contributed to the strength of their dynasties.

It would be misleading to characterise the Gaelic Irish as impoverished. The papal taxation instructions represent average annual income. Unsold cattle and pastoral holdings would not have been included. Gifts, aspects of bartering and direct consumption, and plunder would also have escaped assessment. Rather, the valuations reinforce the concept of a pastoral economy based on barter, billeting and mobility. Gaelic economies may have produced limited surplus for commercial activities and regular trade but could still feed the population and provide for private armies. This is a more substantiated claim than simply suggesting that the valuations are token or that Gaelic Ireland was impoverished by its own anarchy and infighting (as Goddard Orpen argued in Ireland under the Normans). Instead, we are looking at a unique economy and culture.

What next?

Mapping the 1302–20 valuations has revealed a fascinating and multifaceted Irish economy. Although environmental factors played a significant role, there was also interplay between political leadership, exposure to conflict, access to trade and urbanisation. These maps and the database should spur further studies that draw upon additional environmental, regional and archaeological expertise and provide a major step towards an economic benchmark for Ireland comparable to the Domesday Book.

In the next issue of History Ireland I will take an in-depth look at the 1319–20 valuations and maps, and assess the impact of the Bruce Invasion.

Chris Chevallier was recently awarded a Ph.D from Trinity College, Dublin, for his work on ‘Utilizing papal taxation records for geographical, economic, and cultural analysis: a study of early fourteenth-century Ireland’.

FURTHER READING

T. Barry, ‘The Pope Nicholas IV taxation of the early fourteenth century and Irish medieval rural settlement archaeology: a case study’, in D. Sarlet (ed.), L’Urbanisme: Mélanges d’archéologie médiévale (Liège, 2006), 8–15.

B. Campbell, ‘Benchmarking medieval economic development: England, Wales, Scotland, and Ireland, c. 1290’, Economic History Review 61 (4) (2008), 896–948.

T. Finan, Landscape and history on the medieval Irish frontier (Turnhout, 2016).

T. MacNeill, Anglo-Norman Ulster: history and archaeology of an Irish barony, 1177–1400 (Edinburgh, 1980).