The South Sea Bubble: a parable for our own time

Published in 18th–19th - Century History, Issue 2 (Mar/Apr 2009), News, Volume 17The South Sea Bubble: a parable for our own time

The South Sea Bubble—an Allegory by William Hogarth, c. 1721.

The South Sea Company, a joint stock company, was established in 1711 by British lord treasurer Robert Harley as a device for servicing government debt, which had ballooned as a result of the ongoing War of Spanish Succession and previous wars with Louis XIV’s France. It was granted a monopoly on trade with Spain’s South American colonies (hence the name). The government and the company convinced the holders of government debt to exchange it for stock in the company. In exchange, the government granted the company a perpetual annuity of £576,534 annually on the company’s books, or a perpetual loan of £10 million paying 6%. This guaranteed the new equity-owners a steady stream of earnings to this new venture. The government thought it was in a win–win situation because it would fund the interest payment by placing a tariff on the goods brought from South America.

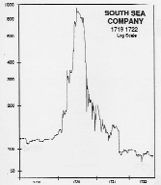

In reality, the company possessed few ships and carried less trade, instead concentrating on servicing the British national debt. Increasing amounts were taken on, often by bribing politicians in the process, while promising fabulous returns on its (virtually non-existent) trading ventures, encouraging private investors. This investment came from all over Europe, with the bulk coming from the British Isles, and by 1720 the demand for stock drove the share price up 1,000%. This speculative mania was driven by expectations that the share price would continue rising indefinitely, a fatal flaw as, in today’s parlance, ‘the fundamentals were unsound’.

In the absence of a domestic stock exchange and established banking sector, vast amounts of Irish capital were ventured in the London exchanges, as Irish investors became anxious not to miss out on what seemed an irresistible opportunity to make great gains. Amongst the Irish investors was Jonathan Swift, who simultaneously invested in the stock market while writing satires attacking stock-jobbers and the new moneyed interest. Esther Van Homrigh, better known as Swift’s Vanessa, was another Irish investor; in her will she left the fortune thus garnered to the philosopher George Berkeley, who used it to finance his attempts to set up a university in America in the late 1720s. One contemporary, Lady Molesworth, from Swords, Co. Dublin, remarked that ‘I believe most of our money of this kingdom is gone over to the South Sea stock for I never saw it so hard to get in my life’, and she was far from alone in expressing such views, as investment mania gripped the whole British Isles.

This price was unsustainable and fell dramatically in the second half of 1720 as investors tried to sell their stock at the top, hoping to make a profit, leading to the collapse of the company’s share price and the ruin of many investors, especially those who had borrowed to purchase their stock. Many of these investors were stock-market novices and were attracted by the prospect of great riches, but they failed to understand the unsustainable nature of the market.

By the middle of 1720 the share price had risen 1,000% but collapsed as quickly in the second half of the year.

The effects of the collapse were felt in Ireland, with a run on the Dublin banks in October 1720 only being halted by the intervention of Speaker William Conolly of Castletown, who used his own immense fortune to bolster the banks’ credit. The money supply also severely contracted owing to the exodus of Irish money to London, thereby reducing trade and compounding the economic hardship caused by successive harvest failures in the years 1718–20. The collapse of the scheme also engendered great suspicions of bankers and financiers, as well as the banking system. This suspicion of credit reached its nadir in Ireland during a public debate over attempts to establish a Bank of Ireland in 1720–1, a project that rose and fell with the South Sea Company share price. The proposed bank was intended to stop the flow of Irish capital to London and to increase the level of credit available in the Irish economy, as well as providing paper currency as an alternative to the scarce coinage then in circulation. Public perception of the role of bankers and the ‘moneyed interest’ in the South Sea affair, aided by polemics by writers such as Jonathan Swift, ensured the bank’s failure. These critiques were often based on misunderstandings of the South Sea or Bank of Ireland schemes, but the suspicions engendered ensured that there was little Irish appetite for any schemes of high finance. There would be no Bank of Ireland until 1783, while the Irish economy entered a decade of recession. HI

Patrick Walsh is an IRCHSS post-doctoral fellow in the School of History and Archives, UCD.